Payments 101

Navigating Payment Options Today

From cash and cards to Buy Now, Pay Later (BNPL), crypto, and Central Bank Digital Currencies (CBDCs), today’s payment options are more diverse than ever. In this video, we explore how these methods are revolutionizing transactions for merchants and consumers alike, driving innovation, and shaping the rapidly changing global economy.

How do card payments work?

Card payments may feel effortless, but each transaction involves a quick, complex process behind the scenes. Retailers, banks, and card schemes all play a role in making payments happen within seconds, millions of times a day across Europe.

Small fees paid by each player help maintain and improve the system. In return, merchants benefit from secure, reliable payments and wider customer reach, while consumers enjoy speed, convenience and trust in every transaction.

How Cards Battle Fraud in Europe

In a rapidly evolving payments landscape, fraud remains a key challenge. Learn how the card industry fights back with advanced security measures like tokenization and AI. Discover how collaboration between regulators and industry leaders in the EU is ensuring safe transactions and building resilience against fraud for merchants and consumers alike.

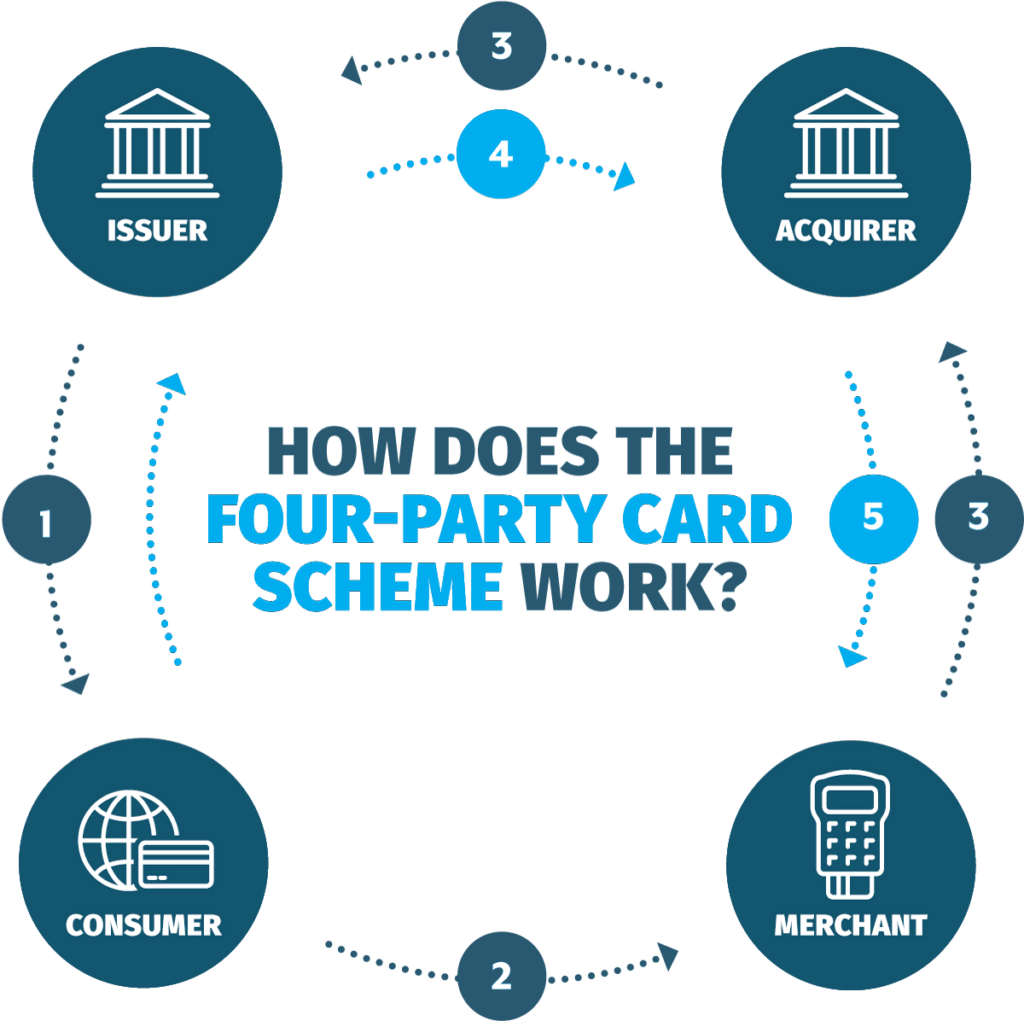

How does the four-party scheme work?

- The issuer offers the consumer a debit, credit or prepaid account with card.

- The consumer uses the card to buy products and services.

- The transaction is submitted to the retailer’s acquirer, who in turn submits it to the consumer’s issuer.

- The issuer authenticates and approves the transaction and transfers amount to the acquirer.

- The acquirer transfers amount to the retailer.