True Value

Country Reports

Payments Europe is committed to research and an evidence-based discussion on payments to promote and inform policymaking in Europe.

Payment Europe regularly conducts research on merchant and consumer sentiment and preference across the region. Local data has been extracted in individual country reports.

Browse reports by selecting a country

- Country report available

- Country report coming soon

Denmark

Danish consumers and merchants have a strong preference for card payments

Payments Europe research reveals key factors behind demand for card payments amongst Danish consumers and merchants

Copenhagen, 21 May 2025 – Payments Europe, the voice of the payments industry in Europe, has published new research on the Danish payments landscape. Based on a survey of consumers and merchants in Denmark, the research highlights the value, cost and place of cards in Denmark’s economy. The report also reveals a highly diversified and competitive payments landscape, with wide acceptance of different payment methods across the board. Key findings from the report include:

Consumers

- 90% of consumers feel that the available payment methods meet their needs.

- Danish consumers have a strong preference for cards, and 91% prefer cards over other payment methods.

- Consumers in Denmark rely significantly less on cash (70%) than their European peers (83%).

- Safety and security are the top priorities for Danish consumers and 75% of them trust their cards more than other payment methods.

- 64 of Danish consumers have not heard of the Digital Euro, and among those aware, 65% are unsure of, or do not see benefits from the Digital Euro.

Merchants

- 78% of Danish merchants prefer accepting electronic payments over cash.

- Danish merchants’ turnover is much less reliant on cash compared to the rest of Europe (39% compared to the European average of 61%).

- Danish merchants prioritise safety and security, cost, consumer preference, and reach when considering which payment method to accept.

- 75% of merchants are satisfied with the payment solutions available to them.

- 84% of Danish merchants agree that the benefits of card payments outweigh the costs.

On the Digital Euro

On average, Danish merchants are more aware of the Digital Euro’s development than their European peer, with 42% of merchants being aware of it. However, compared to the rest of Europe, Danish consumers are not very aware of the development of the Digital Euro. 64% of consumers have never heard of it, 65% are unsure of, or do not see, benefits from the Digital Euro and 52% of Danes are unsure in which scenarios they might use it.

France

In France, cards are the preferred method of payment for consumers and retailers

The proliferation of payment methods available on the French market has been welcomed by consumers and retailers alike. However, all agree on one key priority: security. In this respect, cards are still widely perceived as the most reliable payment method.

Paris, Brussels, 17 April 2025 – According to the latest study commissioned by Payments Europe, France stands out from other European countries as having made a more marked transition to digital payments. French consumers use less cash than the European average, preferring cards for reasons of convenience and security. This dynamic is prompting French retailers to rapidly adapt their payment services.

Robrecht Vandormael, Secretary General of Payments Europe, says:

“Our study confirms that digital payments have become an integral part of French payment habits, much more so than elsewhere in Europe. Merchants now share this reflex and are adapting the payment methods that they offer accordingly. The survey also reveals that French people have already widely adopted new payment methods, such as instant payment, and that they expect to make greater use of them in the future.”

A payments market in the process of transformation

The study, based on a survey of French consumers and merchants, highlights a payments market that is constantly evolving: increasingly digitised and increasingly competitive, responding to users’ growing expectations surrounding simplicity and security.

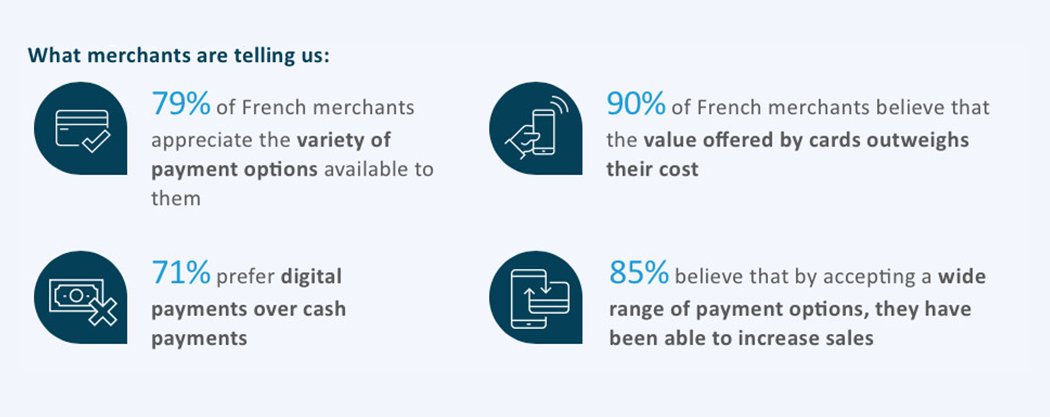

As far as retailers are concerned, this evolution is well underway. 71% of French merchants now express a preference for digital payments over cash. If given the choice, 64% would like to be able to refuse cash. This preference is explained by the additional guarantees and enhanced security that cards offer: 67% of French merchants prefer cards to any other payment method, as it ensures the correct receipt of funds, limits the risk of fraud, and offers a better customer experience.

What’s more, 90% of merchants believe that the value offered by cards outweighs the cost, and 74% of them even say that the cost of cards has fallen or remained stable in recent years.

Cards are becoming an integral part of French life

The use of cash is declining faster in France than elsewhere in Europe: the number of consumers who paid with cash in 2024 was 8% lower than the European average. In shops, 72% of French consumers prefer to pay by card, even when another payment method is available.

Consumers highlight the ease, security and speed of card payments. 74% believe that it offers added value when compared with other payment methods, particularly when it comes to managing returns or complaints, a benefit cited by 81% of consumers surveyed.

78% of consumers say they trust their card more than any other payment method, and 57% consider access to credit to be a key benefit of cards.

What’s more, consumer behaviour is changing: more than half of French people say they are prepared to make greater use of instant payments over the next 12 months. However, certain obstacles remain: 33% cite a risk of fraud linked to real-time transfers, and 22% fear that these payments will not be accepted everywhere.

The digital euro: a concept that is still poorly understood

In line with trends across other European countries, French consumers feel they have limited knowledge of the digital euro and its development, and 44% have never heard of it, with 27% of consumers unsure how the digital euro would benefit them and 25% believing that there would be no benefits at all.

Of the approximately 9% of French consumers who consider themselves to be informed about the digital euro, more than a third believe that its main benefits would be greater speed and convenience.

Germany

German consumers increasingly prefer card payments thanks to their convenience, greater security, and higher efficiency

Latest Payments Europe research on the German payments landscape reveals that German consumers use cards more often than cash, prioritize security, and distrust cryptocurrencies as a payment method.

Germany, March 31, 2025 – Payments Europe, the European association of the card-based payments industry, has published a new study on the dynamic payment ecosystem in Germany. Based on a survey of consumers and merchants in both physical and online retail, the study highlights a market in transition.

Card Payments More Popular Than Cash

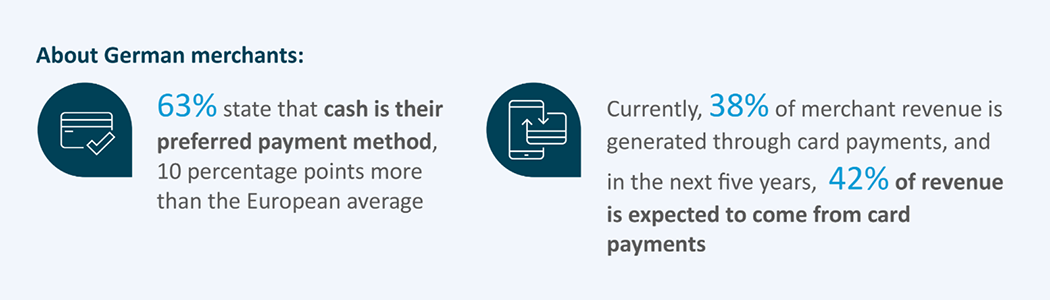

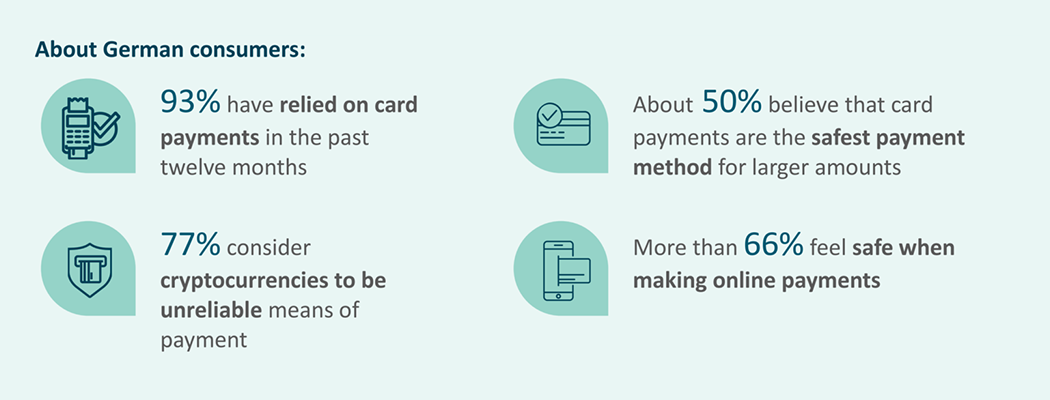

Germany is traditionally considered a cash – oriented country. Therefore, it is not surprising that 63% of all surveyed merchants – 10 percentage points more than the European average – name cash as the most preferred payment method. Cash payments also remain popular among consumers. However, a shift toward card payments is becoming evident: According to the survey results, more consumers have used card payments (93%) than cash (88%) in the past twelve months. Consumers particularly appreciate the convenience and ease of use of card payments in stores.

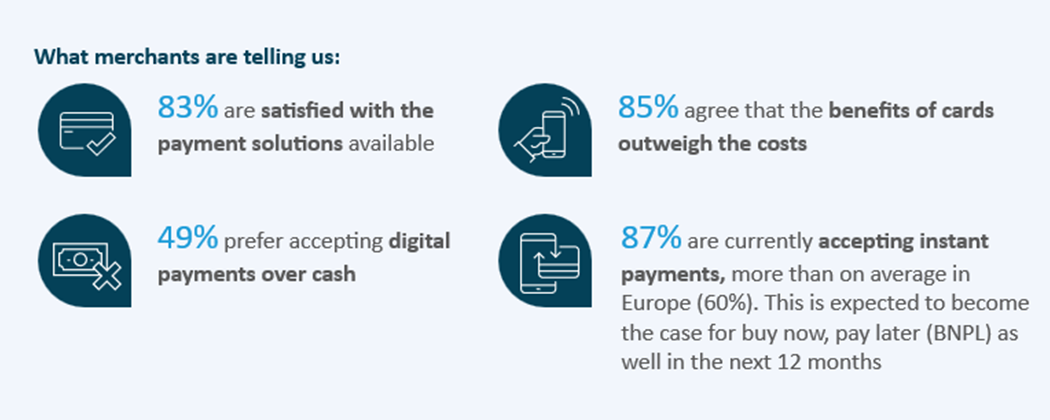

Respondents from both offline and online retail expect this trend toward card payments to continue. Currently, 35% of merchant revenue in Germany is generated through cash transactions, while card payments account for 38%. Over the next five years, merchants anticipate cash transactions to drop to 27%, while card payments are expected to rise to 42%. Additionally, 89% of merchants believe that the benefits of card payments outweigh the costs, with 58% reporting a noticeable reduction in costs over the past five years.

Greta Schulte, Board Member at Payments Europe and Director of Government & Public Affairs at Deutsche Kreditbank AG (DKB), states: “The trend is clear: German consumers increasingly prefer and use card payments – thanks to their ease of use, enhanced security, and greater efficiency in the payment process. At the same time, digital payment methods are becoming more important. Both merchants and consumers benefit from this diversity – the shift toward greater flexibility in payment transactions is undeniable.”

Mistrust of Cryptocurrencies

When choosing a payment provider, German consumers prioritize security, safety and reliability. For merchants, security is also a key criterion – alongside consumer preference and the ability to reach as many customers as possible – when selecting accepted payment methods.

German consumers are particularly skeptical about cryptocurrencies. A significant 77% consider cryptocurrencies to be untrustworthy as a payment method. A lack of trust among German consumers is also evident when it comes to real-time transfers. With this payment method, respondents are most concerned about fraud and the inability to recover funds in case of an error.

Conversely, online and card payments foster greater confidence: over two-thirds of consumers feel secure with online transactions, and nearly half consider card payments the safest method for larger purchase

Greece

The Greek Payments Market is Dynamic, Digital and Competitive According to Consumers and Merchants

Latest Payments Europe research on the Greek payments landscape reveals an evolving and increasingly digitalised market and provides insights into consumer and merchant preferences and priorities.

ATHENS; October 15, 2024 – Today, Payments Europe published new research on the Greek payments landscape. Based on a survey of consumers and merchants in both physical and online retail, the study reveals a market in transformation: increasingly competitive, digitalised, shaped by evolving merchant and consumer preferences.

The shift to cashless payment methods is self-evident, despite the fact that cash is often thought to be the preferred payment method in the country. According to the survey’s results, more consumers have relied on card payments than on cash in the last 12 months, and 83% of Greek merchants believe they will be completing more digital transactions in the next year. This trend is even more marked among younger generations, attracted by the growing choice offered by digital payments methods. More than 70% of Greek Millennials and Gen Z expect to increase their reliance on new forms of digital payments in the next twelve months.

Nonetheless, 71% of consumers believe that cards provide more value than other payments methods and 77% of merchants consider the benefits of cards greater than their costs.

Regarding the criteria that consumers and merchants have in mind when choosing between different payment methods, safety and security are their main priorities. When asked to compare different payment options, cards are ranked highest because they are considered to meet those needs best.

The Digital Euro remains rather unknown in Greece, with only 55% of Greek consumers being aware of it. Of them, 46% are unsure what benefits it would bring. On the merchant side, one in three is unsure how the Digital Euro would benefit them or believe there would be no benefit at all..

Robrecht Vandormael, Secretary General of Payments Europe, said: “The shift towards cashless payments continues to accelerate. This latest research shows that the Greek payments story is in evolution and increasingly digital: merchants appreciate the range of payment options, industry is driving advancements and innovation, and consumers enjoy choice and flexibility. Cards remain a cornerstone of the Greek payments landscape, providing safety, security and reliability, while playing an active role in the market’s digital transformation.”

— ENDS – –

This study is part of Payments Europe’s research series: “Safety, Convenience and Choice: The True Value of Cards.” In 2024 Payments Europe commissioned a European survey of 2,250 merchants working in physical and online retail and 13,000 consumers. Read the full report on Payments Europe’s website. Click here for more information.

Ireland

Marked preference for card payments in Ireland driven by security, speed and convenience

Payments Europe research reveals key factors behind demand for card payments amongst Irish consumers and merchants

Dublin, 28 April 2025 – Payments Europe, the voice of the payments industry in Europe, has published new research on the Irish payments landscape. Based on a survey of consumers and merchants in Ireland, the research highlights the value, cost and place of cards in Ireland’s economy. The report also reveals a dynamic and vibrant payments landscape, driven by a rapidly transforming market that is increasingly competitive, digitalised, and shaped by evolving merchant and consumer preferences. Key findings from the report include:

Consumers

- Having a choice of payments options remains a high priority for consumers, with 88% of those surveyed saying their payment needs are met with options available to them.

- 73% of Irish consumers trust cards over all other payment methods (both at home and abroad).

- 55% of consumers believe cards are the best payment method when considering safety and security, 59% choose cards for their convenience, while 54% choose them for its speed.

- Given the opportunity, 63% of Irish consumers would rather pay with card over cash, with 64% of consumers expected to make more transactions via instant payments in the next year.

- 56% of Irish consumers have not heard of the Digital Euro, and only 8% consider themselves to be knowledgeable about this form of digital payment.

Merchants

- 89% of merchants in Ireland are satisfied with the payment solutions available to them. Merchants rank cards as the payment method that best meet their priorities, which are: safety, security and consumer preference.

- 78% of Irish merchants prefer cards over all other payment methods, which is slightly ahead of merchant preference levels across Europe (77%).

- 85% of Irish merchants believe that the benefits brought about by card payments outweigh the costs, while 82% welcome increased use of non-traditional payments beyond cards and cash.

- 98% of Irish merchants believe their business has benefitted from the guaranteed payment aspect of card payments. In addition, 96% believe card payments have enabled them to increase sales.

- Choice is also a key issue for merchants with 88% believing that accepting a large range of payment options has increased sales.

Robrecht Vandormael, Secretary General of Payments Europe, commented:

“Our latest market research on Ireland shows that that cards are the preferred payment method by both Irish merchants and consumers, offering safety, security, and speed of transaction. From a merchant perspective, it is clear that cards provide a secure, reliable, and efficient payment method that facilitates their growth, supporting the wider economy. This is augmented by a diverse range of payment options, reflecting a healthy and competitive market for consumers. As we’ve seen in other markets, businesses that offer consumers choice are best positioned to be long-term structural winners.

As the Irish payments landscape rapidly evolves with technological advancements and shifting consumer preferences, government policy will play a crucial role in addressing gaps in financial and digital inclusion. This will ensure an inclusive digital journey through the provision of accessible, secure, and user-friendly payment solutions, while supporting efforts to combat fraud, financial abuse, and scams.”

Poland

Poland’s payments market is dynamic, digital and competitive according to consumers and merchants

Latest Payments Europe research on the German payments landscape reveals that German consumers use cards more often than cash, prioritize security, and distrust cryptocurrencies as a payment method.

Warsaw, April 25, 2025 – Today, Payments Europe published new research on the Polish payments landscape. Based on a survey of consumers and merchants in both physical and online retail, the study reveals a market in transformation: increasingly competitive, digitalised, and shaped by evolving merchant and consumer preferences.

According to the survey’s results, more consumers have relied on card payments than cash in the last 12 months, and 77% consider their payments market to be leading or on par in innovation compared to other European payments markets. This trend is even more marked among younger generations, attracted by the growing choice of digital payment methods. In line with the European average, 83% of Polish consumers consider card payments as secure and feel comfortable using cards. 75% of consumers trust their cards more than any other payment method, and for the majority of Polish consumers, safety and security are key factors when choosing a payment provider.

Over a third (37%) of Polish consumers consider card payments to be the best method for in-store purchases. Polish consumers appreciate the convenience (48%), speed (39%), and availability (38%) that cards offer when making purchases in stores. 78% of them also agree that card payments offer greater value compared to other options.

Regarding the criteria that consumers and merchants have in mind when choosing between different payment methods, safety and security are their main priorities. When asked to compare different payment options, cards are ranked highest because they are considered to meet those needs best.

Looking at the merchants’ perspective, it is important to highlight that 69% of Polish merchants think that electronic payments are critical to their organisation (13% higher than the EU average), and 83% of them prefer to accept electronic payments over cash, the highest response rate in Europe.

85% of Polish merchants agree that the benefits brought about by card payments outweigh their costs. Amongst those benefits, 75% of Polish merchants consider cards to have extremely good anti-fraud measures. 71% of Polish merchants think that the cost of handling cash, and its associated risks, works out to be pricier than the cards. This is higher than the EU average.

Robrecht Vandormael, Secretary General of Payments Europe, said: “Poland leads Europe in digital payments, with 83% of merchants now preferring electronic transactions over cash, making the Polish payments market the most digitally advanced in Europe. This shift is driven by what matters most to merchants: consumer preferences, safety, and reach. In fact, 85% of Polish merchants believe that the benefits of card payments outweigh the associated costs. Consumers echo this sentiment — 75% trust their cards more than any other payment method, with safety and security remaining the top priorities when selecting a payment provider.”

The “Safety, Convenience and Choice: The True Value of Cards” report is based on a survey commissioned by Payments Europe and conducted in 2024. The survey was completed by 2250 merchants working in physical and online retail in Austria (250), Czech Republic (250), Denmark (250), Finland (250), Greece (250), Hungary (250), Ireland (250), Latvia (250), and Lithuania (250). In addition to questions on respondent’s payments habits, the results of which are combined to constitute the report, merchants were asked about what type of business they run (sector of activity), size of their business (number of employees and turnover), their familiarity with the decision-process around payment transactions, and whether they conduct their business online or offline. The online survey was also completed by 13000 consumers living in Austria (1000), Czech Republic (1000), Denmark (1000), Finland (1000), France (1000), Germany (1000), Greece (1000), Hungary (1000), Ireland (1000), Latvia (1000), Lithuania (1000), Poland (1000), and Sweden (1000). Respondents were weighted to ensure representativeness by region, gender, and age. Consumers were also asked about their work status, type of household, income, and general financial situation.

Previous waves of merchant and consumer surveys were also conducted in:

- 2023 (1560 merchants). Breakdown by country: France (264), Germany (252), Italy (263), Spain (271), Sweden (242) and Poland (268).

- 2021 (3223 consumers). Breakdown by country: France (544), Germany (539), Italy (530), Spain (540), Sweden (538) and Poland (532).

- 2021 (648 merchants). Breakdown by country: France (109), Germany (110), Italy (110), Spain (110), Sweden (106) and Poland (103).

- 2019 (3120 Consumers). Breakdown by country: France (520), Germany (520), Italy (520), Poland (520), Sweden (520) and UK (520).

- 2019 (680 merchants). Breakdown by country: France (110), Germany (110), Italy (111), Poland (120), Sweden (120) and UK (109).

In 2025 we unveiled our latest research on the European payments landscape. The data reveals a well-functioning, dynamic and vibrant industry, shaped by competition, innovation, and evolving merchant and consumer preference. This report is based on a data collected from 13,000 consumers and 3,750+ merchants across 15 European countries.