New Payments Europe report reveals key traits of the value and cost of cards in today’s dynamic and vibrant payments ecosystem. Based on a survey of merchants working in physical and online retail in Europe.

BRUSSELS; October 12, 2023 – 75% of European merchants prefer digital payments over cash, and 72% prefer to accept cards over other payment methods, according to new research from Payments Europe.

“Safety, Convenience and Choice: The True Value of Cards” is based on a survey of 1,560 merchants working in physical and online retail, in France, Germany, Italy, Spain, Sweden, and Poland. The report underscores how rapidly the payments market is evolving in Europe, with ever-escalating competition among providers, and new products and services becoming available.

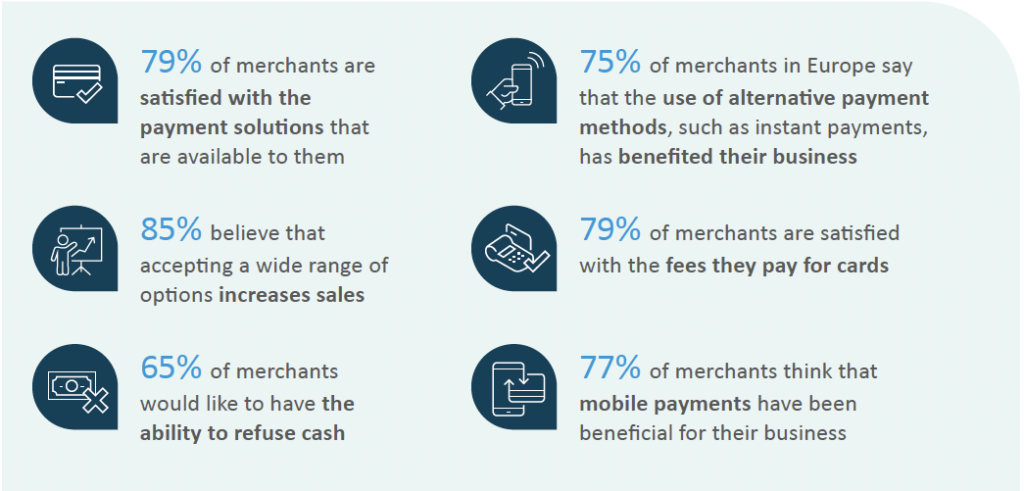

Safety and security are the main priorities for merchants when choosing between payment methods, followed by customer preference, reach, merchant convenience, and cost. When asked to compare different payment options, merchants rank cards the highest because they meet those needs best. 67% of merchants believe the cost of cards has dropped or stayed stable in the last years. 87% of merchants believe the value of cards outweighs the cost.

“Payments are increasingly cashless, and the payments industry is called upon to constantly invest, innovate, protect and maintain resilience across the entire ecosystem,” said Kerri McLaughlin, Member of Payments Europe, from Citi. “Our research shows that merchants welcome diversification; the industry is fostering innovation and security; and cardholders benefit from greater choice. Cards have traditionally played an important role and continue to be the preferred payment solution, delivering innovation and resilience for both cardholders and merchants”.

Sascha Dewald, from Deutsche Kreditbank AG and Member of the Board of Payments Europe commented “Businesses must embed this ever-growing demand for digital solutions into their transformation efforts. It’s one of the key differentiating traits of those better equipped to drive successful outcomes, and it is especially true for small merchants. 99.8 percent of all businesses in the EU are SMEs — which translates to 25 million enterprises and almost 100 million employees. So developing an all-encompassing payments acceptance strategy to drive revenue is not only about business. It’s about unlocking a prosperous Europe.”

“There is widespread opportunity for innovation and growth.” Added Michael Hoffman from Card Payment Sweden and Member of the Board of Payments Europe. “This is an exceptionally exciting time for payments, and we must continue to fuel innovation while maintaining the highest security. Digital and card payments will only continue gaining traction. Card tokenization and other robust security features will take hold. There are so many exciting trends to look out for, and everyone has a part to play to further the digital payments space, from policymakers to civil society. Industry will continue to implement initiatives for the benefit of European consumers, merchants and the economy.”

You can explore “Safety, Convenience and Choice: The True Value of Cards” on Payments Europe’s website, with an in-depth view of the survey data, charts, and more. Download the report.

Methodology

This report is based on a survey commissioned by Payments Europe and conducted in May 2023. The survey was completed by 1560 merchants working in physical and online retail in France (264), Germany (252), Italy (263), Spain (271), Sweden (242) and Poland (268). This survey was also conducted in 2021, 9th to 15th July with 648 merchants. Breakdown by country: France (109), Germany (110), Italy (110), Spain (110), Sweden (106) and Poland (103). Both 2021 and 2023 results have been compared where relevant. For both studies, the countries were weighted to ensure an even representation. Company size in-country was also closely examined to enable comparisons. The report was further completed with desk research based on publicly available sources, from public and private sector

About Payments Europe

Payments Europe is the voice of the card-based payment industry in Europe. Our mission is to promote a better understanding of the complexity of card-based payments and the inherent value it brings to society. We support a vibrant, innovative, and competitive European payments market, that is based on a balanced regulatory framework and that puts consumers and consumer protection at the heart of everything. Payments Europe’s members are card issuers, card acquirers, card schemes and other businesses that offer card-based payment solutions in Europe.

Visit us at www.paymentseurope.eu

Contact Payments Europe: secretariat@paymentseurope.eu